Mukundhan

1992 ME

Chapter 1 – Building a financial foundation Introduction

People in Kerala spend a lot of money on buying lottery tickets, even more than they invest in things like Mutual Funds. Michael Jackson, the famous singer, had a lot of money at one point, but he was in debt when he died. These things happen because many people don’t understand personal finance, which is about managing your money. Personal finance has two parts: numbers and feelings. People often struggle with the numbers part, and that’s why they sometimes make bad money choices.

1. Investing Isn’t Complicated: When you invest money, there are only three things to think about: how much you invest, how much you earn from it, and how long you keep it invested. This is kind of like the compound interest we learn in school. There’s a tool called XIRR that can help us figure out how much we’re making. We should learn how to use it because sometimes people trick us with fake promises about how much we’ll earn.

2.Risk and Safety:

When we invest, we have to think about how risky it is. For example, in Kerala, walking and riding a bike are risky because they lead to more than 50% of accidental death. When we invest, there’s always some risk involved. We need to know about these risks so that we don’t lose our money because of a few bad choices. 3.Different Kinds of Investments:

3.Different Kinds of Investments:

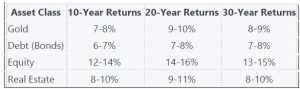

People put their money in different assets, like gold, real estate, or the stock market (equity). Some think gold and houses are the best, but, stocks have been the best choice in India over the past few decades. Here’s a table showing how different things have performed:  4. Goal-Based Plans:

4. Goal-Based Plans:

The best way to plan your money is to think about what you want to achieve, like buying a house, children’s education or retiring comfortably. You put money aside for these goals and keep track of it every year. This is a simple way to manage your money.

5.Passive Income:

Some people invest money to make more money without working. But this takes time, smart choices, and discipline. It’s important not to change your plan when things get tough, like during a crisis.

Often, people who invest get overwhelmed by numbers. As a result, they might not make the best returns on their investments. But, dealing with emotions is even harder than handling numbers. Emotions can be influenced by family, friends, or what others are doing. Sometimes, emotions lead to buying and selling investments too often. This can cost more in taxes and fees and might mean missing out on potential profits. That’s where an advisor comes in. An advisor is like a mentor, guide, and teacher. They can give advice, suggest ideas, and help you make better choices with your money.

We will dive deep next time to understand various types of asset classes and respective risks and returns.